When speaking of the College’s wealth, most people are referring to the Endowment. This is the College’s investment portfolio that is invested for the very long term and that provides an annual distribution to the College that funds the College’s operations in perpetuity. It is managed completely separately from the College’s day-to-day or ‘operational’ finances.

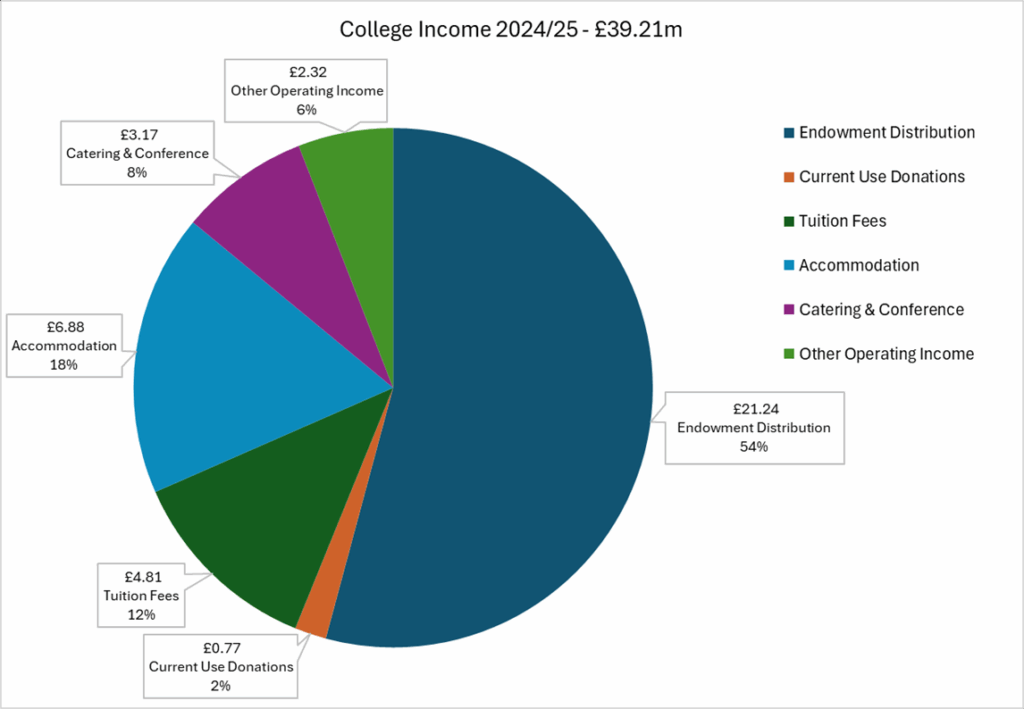

The distribution from the Endowment to the College each year supports over 50% of the College’s operating costs and thus the way it is invested and managed is critical to the success of the College and its ability to fulfill its charitable purposes.

The two key investment objectives for the Endowment are: firstly, that it provides a sustainable and reasonably stable distribution to the College each year (currently c.3.3% of Endowment value) that at least maintains its real (i.e. inflation adjusted) value; and secondly, that the Endowment grows such that it at least maintains its real (i.e. inflation adjusted) value, with donations to the Endowment adding to Endowment value. In this way, the College can be ‘inter-generationally equitable’ i.e. achieve an appropriate balance between funding current and future beneficiaries.

Given the College’s very long-term investment horizon, the Endowment is invested for total return and predominantly in ‘growth assets’ such as equities, private equity, property, infrastructure and private credit and with a significant allocation to illiquid asset classes. The College consequently bears investment risk and returns can naturally be subject to volatility, but this asset mix is appropriate for an institution with an effectively perpetual perspective.

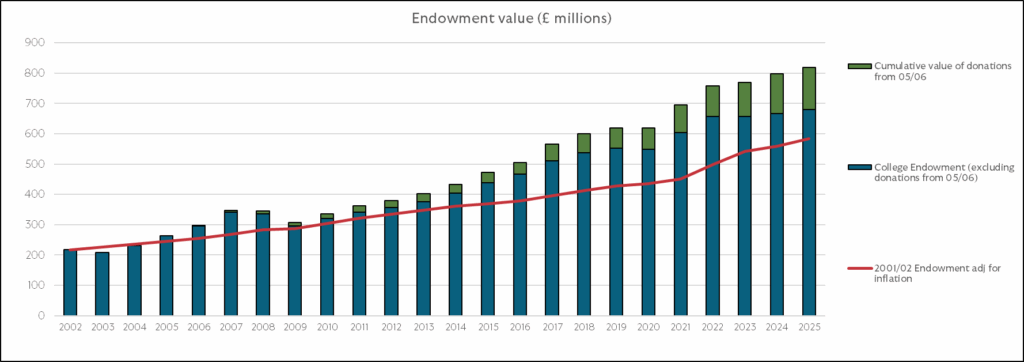

The chart below shows the growth of the Endowment since 2002 (when the Endowment could first be properly valued following the introduction of annual valuations of its property assets). Shown separately in green is the value of donations to the Endowment received since June 2005 including their accumulated and undistributed investment returns. This shows both the importance of recent donations in building the Endowment and that the original Endowment has maintained its real value over this period, though recent high inflation has significantly eaten into the buffer that has been built during periods of high investment returns.

Income and Expenditure

Set out below is a chart that shows the sources of income of the College. The Endowment distribution provides over half the income, and other key components include: tuition fees (including Home undergraduate fees which have fallen by over 25% in real terms since 2012); accommodation income, principally from our students; catering and conference income (from our members but also from commercial activities such as private dining and conferences, though we deliberately limit the latter to ensure core activities such as Johnian and outreach events have priority); and current use donations (which are gifts received to be spent immediately on College activities). Other operating income includes receipts from interest income, Choir tours, tourism, filming etc.

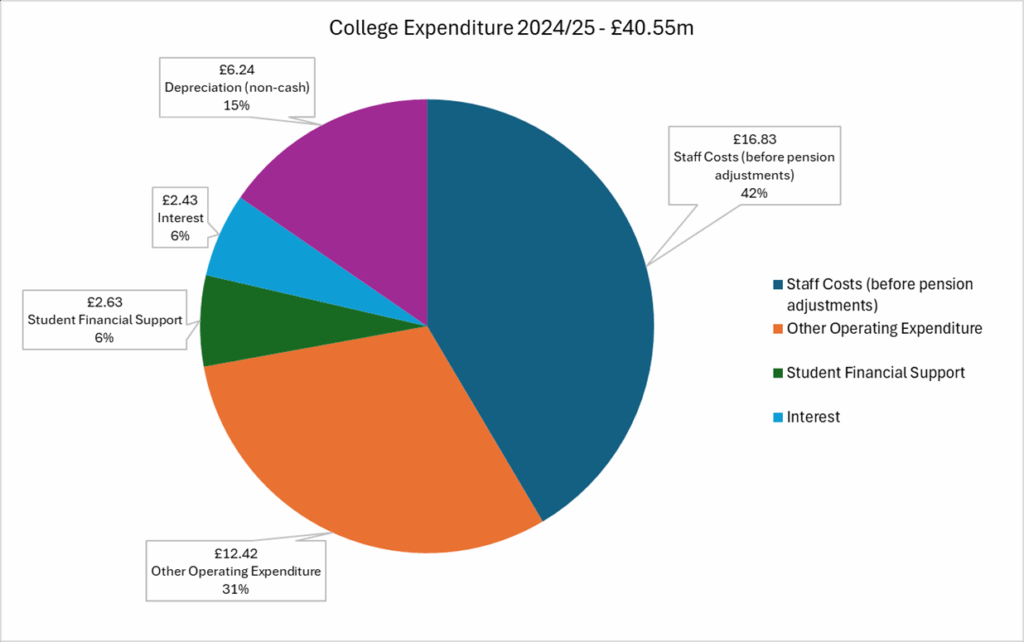

The chart below summarises the College’s expenditure. This shows the key elements of our cost base: the significance of staff costs, which is to be expected given the high intensity supervision and welfare system in Cambridge, the wide range of College activities and the complexity of the College environment; student financial support, reflecting our ambitions to provide significant financial assistance to our students; interest incurred on debt to refurbish our buildings; and depreciation, the significance of which reflects the scale and nature of the College estate.

To be in a sustainable financial position, the College should be breaking even post-depreciation. The College has moved from a position of being close to this position in 2018/19 to one where a recurring deficit is being incurred. This was initially largely due to the adverse effect on College finances of the Covid pandemic in 2019/20 and 2020/21, but whilst the College has recovered from effects of the pandemic, the effects of high inflation, the real-terms drop in undergraduate fees, increasing staff costs (due in part to the very tight Cambridge labour market) and rising debt interest and depreciation as the College invests in its buildings and IT, have served to prolong the deficit position.

A perennial challenge for the College is the need to refurbish and invest in our buildings, many listed, and to maintain our estate, an important part of the country’s architectural heritage.

Between 2006 and 2016 we undertook perhaps the most comprehensive restoration of the College’s buildings since its foundation in a programme that cost some £63 million (and included Cripps, Merton Hall, the School of Pythagoras and the Old Divinity School/Corfield Court). After a few years of lower expenditure, we have now embarked on an even larger plan aimed at not only refurbishing what we have but also improving what we can offer.

This programme includes the Buttery/Café/Bar in Second Court and the new Porters Lodge/office facility on the corner of Cripps Lane and Northampton Street, completed in 2023 and 2024 respectively. Further projects are aimed at providing new or enhanced student accommodation in clusters close the main College site and comprise: extending and refurbishing hostels offering 42 rooms in Portugal Street very close to College; the conversion of 12/12A Madingley Road to provide nine one and two bedroom flats for students with partners or families (both completed in 2025); building a new postgraduate community of 133 en-suite rooms on Mount Pleasant, only a few minutes walk from the western side of College; and adding to and improving a cluster of rooms in hostels and flats, the Warehouse/Bridge Street project, next to Magdalene Bridge.

An important element of these projects, and their cost, is the need to reduce the carbon footprint of the College through building and refurbishing to high environmental standards involving fabric improvement, introduction of new heat sources in place of gas boilers, and renewable energy production. This programme is challenging financially, especially as the College is still repaying debt taken on to fund the 2006 – 2016 refurbishments. Philanthropy, as with the previous programme, can play a major role in enabling the College to carry out this important and transformational series of developments of the operational estate.

Much has been achieved in recent years to improve the College’s finances against some significant headwinds. Notwithstanding this, the College continues to face a number of significant financial challenges: frozen home undergraduate fees; the need to sustain and build-on our student support; the legacy effects of high inflation; tight labour markets in Cambridge putting pressure on staff costs; and the need to continue to invest in our IT and buildings (for refurbishment, for new facilities and to meet our ambitious sustainability targets). In order for the College to continue to adapt, improve and thrive, continued philanthropic support will be critical.

The College's present resources are sufficient to maintain its current operation; yet the history of St John's is not one of merely drifting with the circumstances of its time…

To push beyond our limits and adapt and improve, we need more than our present finances can sustain. Your support is critical, and with solid financial foundations already in place, you can be confident that your donation will be used directly to fund new projects that will keep St John’s at the forefront of Higher Education.

Donate